Loans

- Local: All decisions are taken here in the best interest of all members.

- Member service: We excel in the personal service which we provide to members.

- Straight forward: There are no hidden fees or charges on our loans.

- Flexible: You can pay off your loan early, make additional lump sum repayments or increase your regular repayments, all without penalty. Generally. there is no minimum loan period.

Can you get a Loan at a lower interest rate?

Consider the following...

- How easy is it to get a loan from your bank?

- Is your loan being repaid on a reducing Balance?

- Does your Lender give you an Annual Interest Rebate on your Loan?

- Does your Lender penalise you if you miss a payment?

- Most banks won’t lend less than £1,000 or for shorter than 12 months. So you might end up borrowing more than you need, or can afford.

- Some personal loans have variable interest rates, meaning they can go up or down.

- Are you being charged arrangement fees, which will make a loan more expensive.

The Consumer Credit (Early Settlement) Regulations 2004 allow lenders to charge up to 58 days interest in the event that a customer decides to repay their loan in full early.

Loan Criteria

All loan applications are dealt with in strict confidence.

Before a loan can be considered the member must comply with the following:

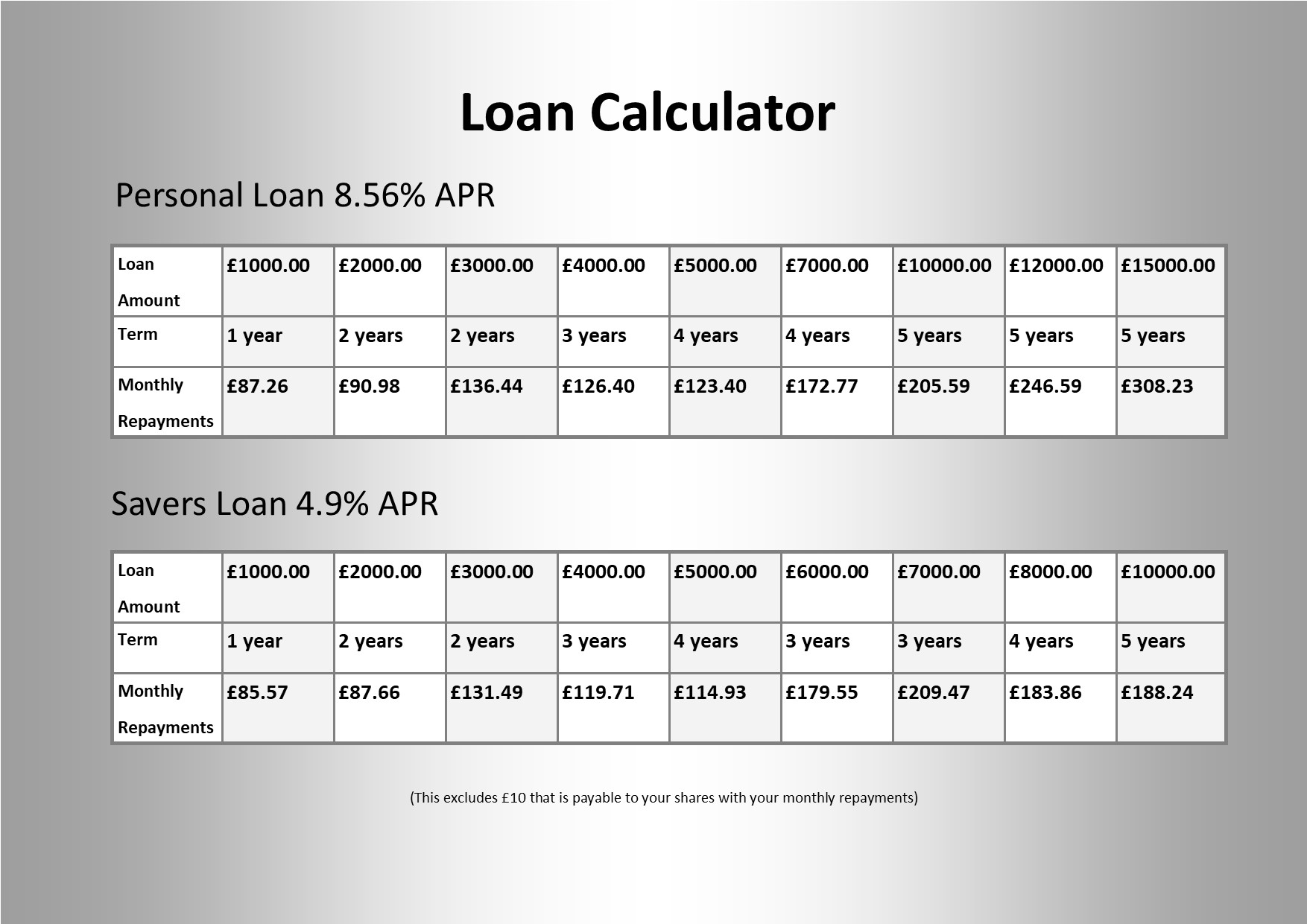

Personal Loan

- The Maximum Personal Loan is £15,000 @ 8.9% APR.

- The maximum repayment period is 5 years.

- You must have at least £2500 in shares in order to apply for the Maximum Loan of £15,000.

- All Loan applications are subject to a Credit Check.

- Members must save for at least 13 weeks and have a minimum of £500 in their shares before they can apply for a loan.

- Members may borrow 6 times their share balance up to a maximum of £15,000.

- Members may top up their loans, provided the current loan is not in arrears.

- The loan committee reserve the right to request 3 months’ bank statements to verify information provided on any application.

If you are aged between 18 and 75 your loan will be cleared in the event of your death.

Saver Loan

- Maximum Saver Loan is £10000 @ 4.9%APR

- Members can borrow up to the balance of their shares.

- Members may top up their saver loan, provided their current loan is not in arrears.

If you are aged between 18 and 65 your loan will be cleared in the event of your death.

Loan Repayments

Loan Repayments

- Your loan must be repaid as frequently as stated on the application form, i.e. weekly or monthly. The maximum period for the loan is 60 months. However, this can be repaid in a shorter time if desired.

- If you opt for weekly repayments, your first repayment is due within one week of your loan being issued.

- If you opt for monthly repayments, your first repayment is due on the same date each month as your loan was issued.

- A minimum of £10 per month or £2.50 per week is required to be lodged into shares as part of the loan repayment

If your circumstances change which mean that you are unable to make repayments of your loan or you are worried about your financial situation, please make sure you contact us as soon as possible. The sooner we are aware of any problems you may be facing the sooner we can help.